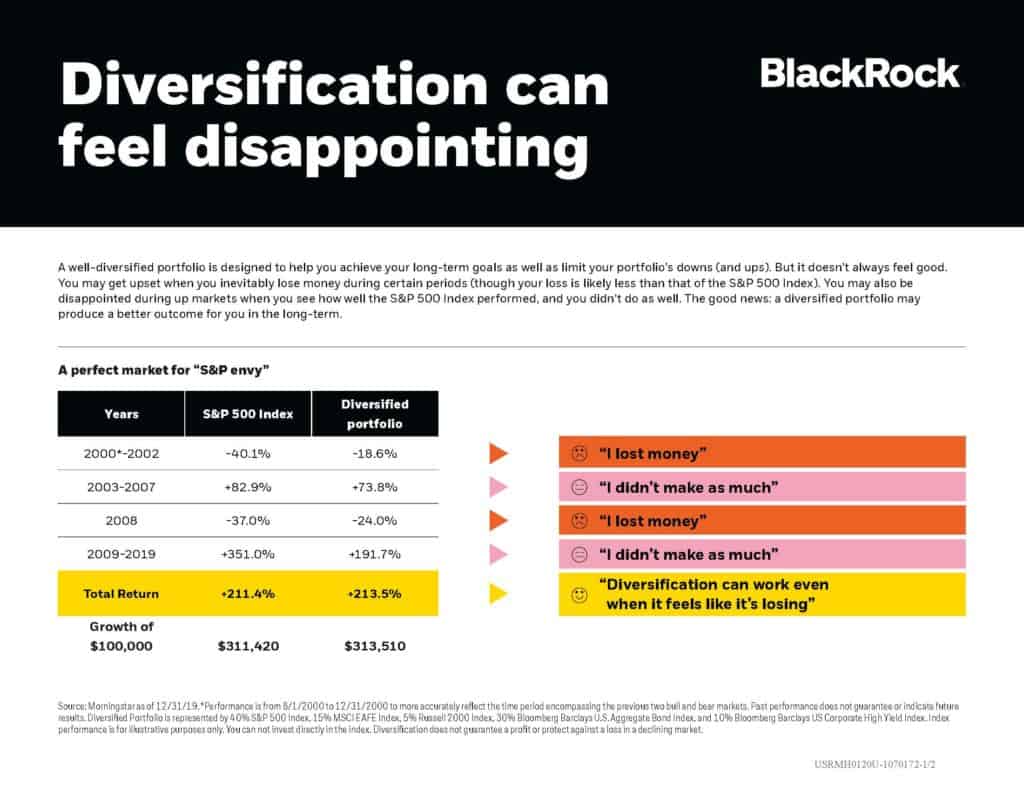

We just wanted to give you, our clients an update regarding the marketplace and where we are. As stated earlier in our previous post regarding our Business Continuity Plan, we are still actively managing your portfolios even as the market goes down. We are following the core principles of the marketplace using diversification and by continually re-balancing your accounts as needed. Right now we are strategizing by grabbing equities at a low price –using the classic buy low and sell high concept. Just as a reminder, we are not buying individual stocks or bond securities in your accounts, we purchase Mutual Fund or ETF securities (which are pooled funds). For example, our Balanced Model currently contains between 13k-14k positions in order to keep you highly diversified. We actively monitor each of those individual securities within each fund in order to prevent excessive overlapping of the same securities positions as well. Key point - you are highly diversified. Please see the "Diversification Can Feel Disappointing" chart to the left for some information.

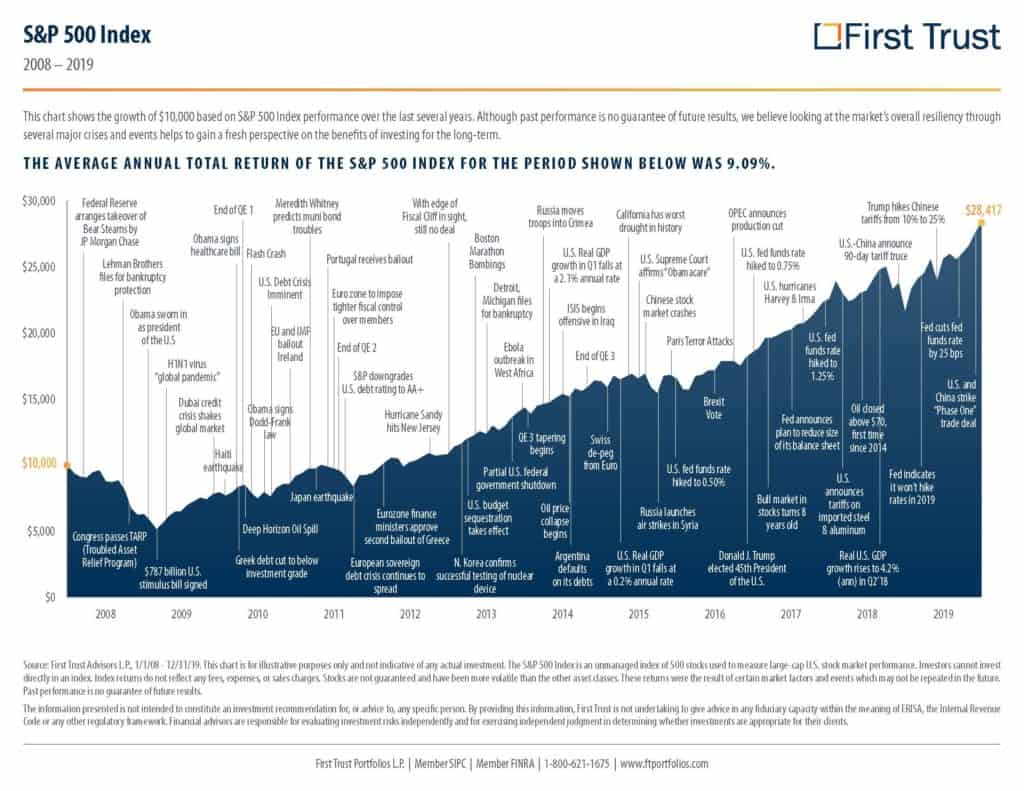

In times such as these, we are reminded that there is always a silver lining with regards to the markets – opportunity. Please see the next chart to your right, "Crisis and Events", which shows all of the crisis' we have faced from 2008-2019. As you can see, there have been many crisis'. But we are a very resilient nation and we will ride this out just as we have before.

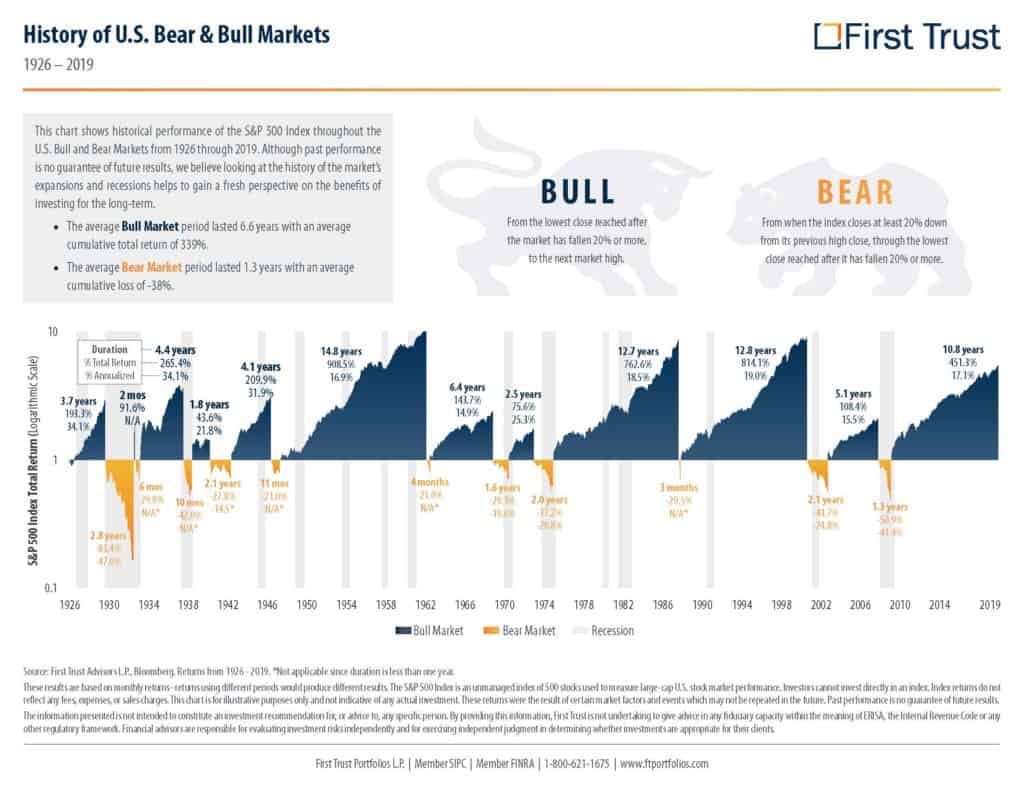

And last but not least, the last chart to the left, "History of US Bear & Bull Markets" shows the US S&P 500 Index historical Bull & Bear markets since 1926. The average Bull Market period lasted 6.6 years and the average Bear Market period lasted 1.3 years. It's an interesting chart that hopefully shows that we have been here before and it always bounces back.